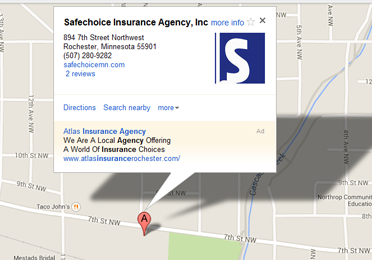

In Minnesota, the No-Fault Automobile Insurance Act requires everyone who is on the roads in the state to have basic auto insurance. This includes personal injury protection, liability insurance and uninsured/underinsured motorists coverage. This protects you and anyone else in your vehicle as well as protecting the people and vehicles that you are involved in an accident with. But in an accident where you are at fault, it does not cover your vehicle. At Safechoice Insurance Agency in Rochester, MN our agents can help you understand if this is the coverage you need or if you need additional coverage.

While the law requires you have these basic coverage, you have the option of adding additional coverage that can offer more protection. If you have assets you may want to have more liability insurance than just the basic amount. If you have a vehicle that has a reasonable amount of cash value you may also want to provide insurance that can help repair or replace it in the event that it is damaged.

Collision is additional coverage that provides the money that you need to have your vehicle repaired or replaced in the event of an accident. It usually has a deductible that you determine. If you would not be able to pay for the repair or replacement of your vehicle on your own or it would be a hardship, this can be very important coverage.

Comprehensive insurance covers damage that results from something other than an accident with another vehicle. It can be weather-related damage such as hail or high winds or it can be vandalism. If your car is stolen, comprehensive insurance is what covers its loss.

Basic auto insurance may be right for you but if you aren’t sure Safechoice Insurance Agency in Rochester, MN has the knowledgeable staff to help you to make the right decision. Give us a call or stop by our office for a no-obligation quote.

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions