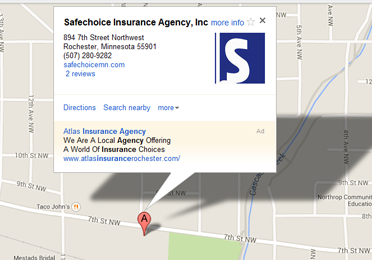

Safe driving in Minnesota requires knowledge of how to navigate roads in any condition. Whether you’re enjoying the rural roads of Minnesota in spring and summer or navigating the colder conditions of fall and winter, driving in Minnesota means being prepared and alert all year round. Here are some tips for year-round driving that will keep you safe in any situation. For additional protection, ensure you have the right auto insurance from the team at Safechoice Insurance Agency in Rochester, MN.

Year-Round Driving Tips for Minnesota Residents

In spring and summer, driving safely is generally easier as you’ll be following the standard rules of the road. Pay attention to road conditions and other drivers, never drive under the influence of alcohol, and use your resources (like lighting) to stay safe and alert. Fall and winter driving can be more challenging due to extreme weather like rainstorms and snow. When driving in rain or snow, slow down to avoid hydroplaning or colliding with a vehicle you can’t see, maintain your vehicle to prevent low fluids or tire pressure from becoming a problem during winter, and avoid driving altogether if road conditions are unsafe. If you do get into an accident, having auto insurance is crucial, so ensure you have a reliable policy all year round.

Find Car Insurance Policies in Minnesota With Safechoice Insurance Agency

At Safechoice Insurance Agency in Rochester, MN, we prioritize your safety by helping you find coverage that will support you on the road and beyond. Compare quotes now to secure a policy that will keep you safe on Minnesota roads, no matter the time of year!

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions