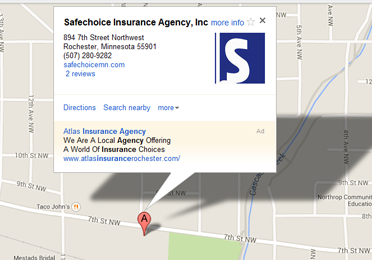

If you plan to buy a motorcycle, you’ll need the right insurance. The professionals at Safechoice Insurance Agency, serving Rochester, MN, can help you find a suitable insurance policy for your needs.

If you have questions about motorcycle insurance, we can help! We’re here to provide assistance and information to people who want to know more about insuring their motorcycle. Here’s what you need to know.

Is Motorcycle Insurance Required?

Motorcycle insurance is required to drive a motorcycle on Minnesota roads. It must provide the minimum liability coverage required by the state.

If you buy a motorcycle, you will be required to have this minimum amount of liability coverage to drive the motorcycle away. This means you’ll want a policy that is ready to go when you buy your motorcycle. Getting started with an insurance agent can help speed the process along when you’re buying a motorcycle at a dealership.

If you’re interested, talk to your insurance provider about additional insurance to help protect you and others on the road. Getting more than the minimum amount can help protect your motorcycle and may also provide medical coverage for you and your passengers if you are in an accident.

How Do I Find the Right Type of Motorcycle Insurance?

Finding the right type of motorcycle insurance can be a challenge. At Safechoice Insurance Agency, serving Rochester, MN, our insurance professionals can help you find the best insurance policy for your vehicle and budget. We’re here to help.

We work with many carriers, so shopping around for a policy is easy. Call today to speak with one of our insurance professionals and get started.

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions