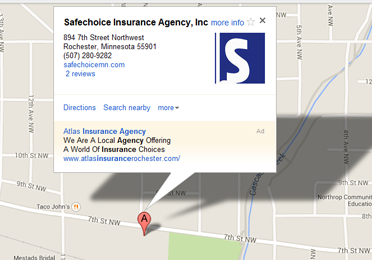

When considering home insurance, homeowners often focus on the contents inside their house. But what about the exterior? If you’ve recently added an outdoor structure like a pool, gazebo, deck, trampoline, shed, or even a balcony, you might be wondering if you need to inform your home insurance company. At Safechoice Insurance Agency, providing home insurance throughout the Rochester, MN region, we’re here to explain why keeping your insurer in the loop is a wise decision.

The Importance of Informing Your Insurance Company

Adding a new outdoor structure can enhance your property’s value, but it also introduces additional risks. For instance, while a swimming pool or trampoline can be fun additions, they also increase the chances of accidents or liability claims. By informing your insurer, you ensure that your policy reflects these changes and provides the necessary protection. Neglecting to update your policy could leave you underinsured or, in some cases, without coverage for those new structures.

The Consequences of Non-Disclosure

If you fail to inform your insurance provider about changes to your property, you could face complications when filing a claim. For example, if a storm damages your new deck or shed, but it wasn’t included in your policy, you may not receive reimbursement for repairs. Similarly, liability issues arising from unreported structures could result in denied claims.

Stay Protected, Stay Safe

Keeping your home insurance policy up to date is the best way to safeguard your investment. If you’ve recently added any outdoor structures, contact Safechoice Insurance Agency, serving the greater Rochester, MN area today. We’ll ensure your policy is tailored to fit your needs and that your home is fully covered—inside and out!

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions