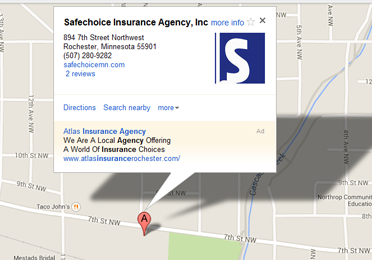

The team here at Safechoice Insurance Agency is proud to serve the insurance needs of the greater Rochester, MN area. If your auto policy isn’t cutting it anymore, we can help you with an upgrade! Our team is here to help you find the right policy for your needs. Get in touch today!

Benefits of roadside assistance

One of the most basic and obvious advantages of having a roadside assistance benefit included in your auto policy is that you will get the help you need if your car breaks down or is involved in an accident. Having this service through your auto insurance provides another layer of benefit.

When you are involved in a mishap or your car is inoperable due to a covered event, you will need to work with your insurance company to repair or replace it. If the vehicle is going to be fixed, your insurance company will probably have specific stipulations and requirements. If the tow truck you call takes your vehicle to an unapproved repair shop, the work may not be covered.

Using the roadside assistance that comes with your policy ensures that you work with approved vendors. This will help the claims process go much more smoothly. Getting your car fixed is already stressful enough. There’s no reason to add insurance issues to the process!

Give us a call today!

Rochester, MN area drivers can rely on Safechoice Insurance Agency for their insurance needs. If it’s time to upgrade your policy, give us a call or come by our office to find out more about the options available in our area. We look forward to working with you!

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions