Life insurance is not required like auto and health insurance, but it is still a good idea to have. There are many types of life insurance and it can provide your family with protection in the event of your death. It is not a necessity for you, but the benefit that is left behind may be a necessity for your spouse and your children.

There are going to be expenses that occur when you die. There are not only funeral costs, but also living expenses that must be dealt with. If you are no longer around to provide income, it can be hard for your family to cover the mortgage, debt, and many other expenses. The death benefit can provide this financial assistance.

It’s important to figure out how much you need. Some questions you may want to ask include:

– How much family income do you provide?

– Are children’s college tuition costs taken care of?

– How much would my spouse be left with?

– What are the estate taxes to be paid?

All of these questions and more have to be considered when you shop for life insurance. Our independent agents can help you determine what kind of coverage you need. This way you can obtain a policy and have the protection for your family. If you should pass before your family members you know that they are taken care of, at least financially.

Many people believe life insurance is for them. It’s not; it’s for those you leave behind. Depending upon where you are in life, there will be different considerations to make with a life insurance policy.

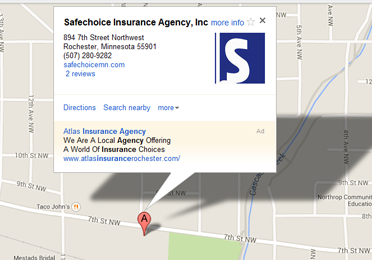

You want the best protection you can in Rochester, MN and we’re here to help. Call and talk to an agent today so we can talk to you more about the options that exist.

URL Slug

/life-insurance-is-it-necessary

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions