Filing a health insurance claim and navigating the claims process doesn’t have to be complicated. By using effective strategies to maintain organized health records and understanding the steps involved in filing claims, you can simplify the process.

Keeping Records of Medical Procedures

Maintain a detailed record of your family’s medical appointments and procedures. Request an itemized receipt during each office visit to ensure you have a clear record of the services provided.

Store these records in a secure and easily accessible location, such as a locked file box or safe. This ensures that if you ever need documentation for a specific medical service received by you or a family member, you can quickly retrieve the necessary information.

Filing a Health Insurance Claim

Depending on the situation, either you or the medical provider who performed the services may be responsible for filing the insurance claim. When visiting a medical office, you will typically be informed about the filing protocol they follow.

If you are responsible for filing the claim, you will need to submit the required documentation as outlined by your insurance provider. This information is usually included in the paperwork you received when you purchased your health insurance policy.

If the medical provider is responsible for filing the claim, their staff will complete and submit the necessary forms on your behalf.

Speak to an Insurance Agent in Rochester

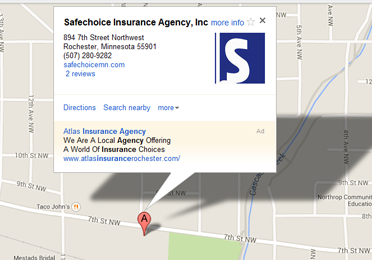

If you have questions or concerns about your family health plan or the steps involved in filing a claim, don’t hesitate to contact our office. An insurance agent at Safechoice Insurance Agency in Rochester, NY, will be happy to consult with you and schedule an appointment at your convenience.

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions