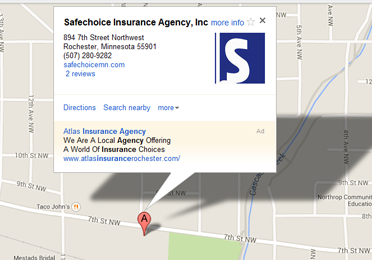

If you are a homeowner, your home represents your hopes and dreams. Most homeowners take steps to protect their future by purchasing home insurance. If your home is near Rochester, MN, our team at Safechoice Insurance Agency can help you understand your home insurance options. We’ve been assisting homeowners in your area since 2004.

What Isn’t Covered by Home Insurance?

While home insurance provides coverage for many types of damage, there are certain exclusions you should be aware of. According to the Minnesota Department of Commerce, most home insurance policies do not include flood insurance. If your home is in a flood-prone area, your insurance agency can help you find separate flood insurance coverage. Additionally, ask your agent about other items not typically covered, such as sump pumps.

Structures like swimming pools, detached sheds, or garages are often excluded from standard home insurance policies. High-value items, such as antiques, jewelry, or musical instruments, may require a separate policy or additional coverage. Furthermore, items used for a home business are not covered under a typical home insurance policy. If you work from home, you’ll need a commercial insurance policy to protect business-related items.

Contact Safechoice Insurance Agency Today

Disasters can strike unexpectedly, but home insurance can provide vital support in the aftermath. At Safechoice Insurance Agency, we are committed to offering excellent coverage at competitive prices. Homeowners in the Rochester, MN area have trusted us for over 22 years to protect their homes and investments. Call us today to schedule an appointment and learn how we can help safeguard your home.

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions