You can’t predict the future, so it’s not easy to know how much home insurance you might need. The best thing to do is to work with an agent from Safechoice Insurance Agency for your homeowner’s coverage in the Rochester, MN area to help you plan for possible future events. They can help you sort through what to consider while you’re planning for your homeowner’s insurance coverage while staying within your budget. Here are some items for you to have in mind when you speak to an agent.

- Deductibles – Higher deductibles will decrease your premium, but if something happens, you will need to pay that deductible. Know how much of a deductible you are comfortable paying for an incident.

- Replacement Cost or Cash Value – Decide if you would like the cost of replacing your home or valuables without depreciation or if you would rather have the actual cash value after depreciation.

- Know Your Policy – Work with your agent, so you clearly know what is covered under your plan. For certain events, you may need a separate policy.

- Discounts – You may be eligible for discounts, such as car and home insurance with the same company, installing an alarm system, or dead bolts.

- Annually – Review your policy at least once a year with your agent to ensure you have adequate coverage.

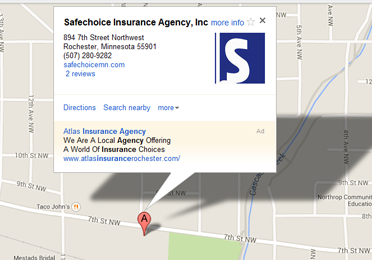

Safechoice Insurance Agency

If your home is in the Rochester MN area, Safechoice Insurance Agency is an excellent insurance agency to work with to help you determine your coverage needs. A professional agent will take the time to explore your home insurance options. They will help you make policy decisions that will provide the coverage you need at a price that will fit your budget. Contact us today to get started.

Email an Agent

Email an Agent Contact

Contact

Click to Call

Click to Call Get Directions

Get Directions